BLOG

Navigating the Shift: Crafting a Business Finance Plan for Entrepreneurial Triumph

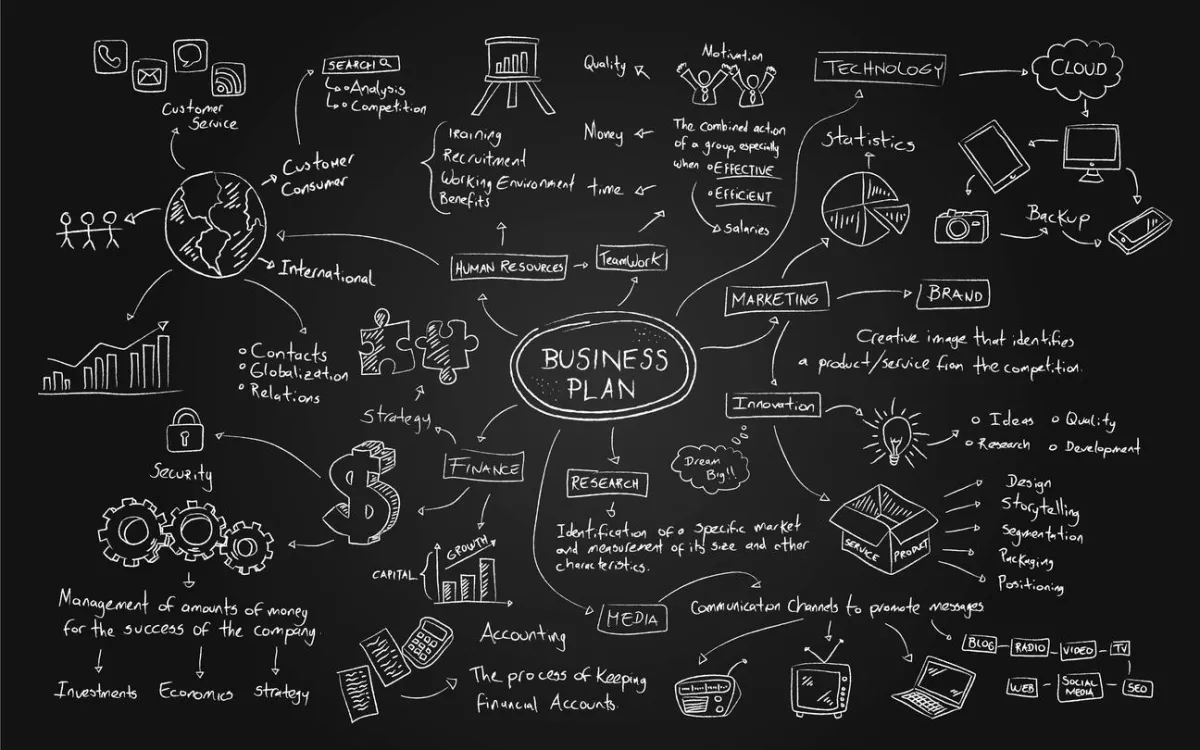

Embarking on the entrepreneurial journey is akin to setting sail into uncharted waters, where the thrill of independence meets the intricate challenges of strategic financial planning. Central to this voyage is developing a comprehensive business financial plan, serving as a navigational tool guiding aspiring entrepreneurs through the fluctuating landscapes of business growth, operational costs, and investment strategies. This article sheds light on the transformative journey from employment to entrepreneurship, underlining the crucial role of financial planning, market research, and a profound understanding of cash flow management in securing a firm's economic health and attracting potential investors.

Why is a meticulously structured business financial plan essential for entrepreneurial success? How can aspiring business owners adeptly manage cash flow, operational costs, and anticipated expenses while navigating the complexities of raising capital? Furthermore, what advantages do acquiring established businesses with a solid financial plan and proven profit and loss statements offer? We delve into these pivotal questions, providing insights into effective financial planning services, including crafting cash flow statements, balance sheets, and economic forecasts. This exploration is not merely about securing funds but cultivating a mindset and strategic acumen essential for confidently steering the entrepreneurial journey.

Prepare to embark on a venture that transcends leaving a job to start a business. This article serves as your guide to comprehending the nuances of creating a small business financial plan, integrating financial projections, sales forecasts, and break-even analysis to ensure your entrepreneurial venture is both a leap of faith and a calculated stride toward achieving business success. By understanding the importance of financial statements like the income statement and balance sheet and employing financial planning techniques, aspiring entrepreneurs can better prepare for future expenses, business insurance expenses, and equity capital needs, ultimately crafting a business plan that appeals to business partners and sets a firm foundation for sustained growth and financial stability.

Crafting Your Business Finance Plan: The Foundation of Entrepreneurial Success

Embarking on the entrepreneurial journey transforms the abstract dream of business ownership into a tangible reality. Developing a comprehensive business finance plan is at the core of this transformative process. This plan serves as a roadmap to navigate the complexities of business growth and investment and as a critical tool for securing the necessary funding to fuel your venture's success. The importance of a meticulously crafted business finance plan cannot be overstated, as it embodies the strategic planning, resilience, and financial acumen required to thrive in the competitive landscape of entrepreneurship.

The Role of Strategic Financial Planning

A business finance plan is more than just numbers on a page; it reflects your vision, a detailed projection of your financial future, and a beacon that guides your decision-making process. It encompasses various elements, including cash flow forecasts, profit projections, and a comprehensive analysis of your revenue streams. This financial blueprint enables entrepreneurs to set realistic goals, manage resources efficiently, and identify potential financial pitfalls before they arise.

Navigating the Investment Landscape

Securing funding is a pivotal challenge for many aspiring business owners. A well-structured business finance plan is instrumental in navigating this landscape, offering clarity to potential investors and financial institutions about your business's viability and growth potential. Whether through venture capital, angel investors, or traditional bank loans, a compelling financial plan demonstrates your commitment to fiscal responsibility and strategic growth.

Acquiring Established Businesses: A Strategic Move

For many entrepreneurs, acquiring an established business presents a unique opportunity to bypass some of the initial hurdles of starting from scratch. A robust business finance plan also plays a crucial role in this context, providing a detailed analysis of the target company's financial health, market position, and growth prospects. This strategic move, backed by thorough financial planning, can offer a quicker path to profitability and scale.

The journey from employment to entrepreneurship is fraught with challenges and uncertainties. However, creating a sound business finance plan lays the groundwork for a successful transition. It equips aspiring business owners with the knowledge, strategies, and confidence to navigate the investment landscape, manage financial risks, and ultimately achieve their entrepreneurial goals. As we delve deeper into the intricacies of financial planning and capital raising, remember that the foundation of any successful business lies in its ability to plan and execute its financial vision strategically.

Financial Planning: The Keystone of Entrepreneurial Ventures

In entrepreneurship, the creation and execution of a financial plan stand as the cornerstone of success. This critical component outlines a business's economic trajectory and is a vital communication tool with potential investors, financial institutions, and stakeholders. The essence of a financial plan in a business plan is to forecast future economic outcomes and prepare the groundwork for sustainable growth and profitability.

The Significance of a Comprehensive Financial Plan

A well-conceived financial plan of business encapsulates various financial statements, including cash flow projections, income statements, and balance sheets. These documents collectively offer a snapshot of the business's current economic health and potential for future earnings. For entrepreneurs transitioning from employment to business ownership, understanding a financial plan for a business and integrating it into their business model is paramount. It demonstrates a commitment to fiscal responsibility and enhances the business's credibility in the eyes of finance business planning experts and investors.

Strategies for Raising Capital

Raising capital is often the most formidable challenge faced by new entrepreneurs. Raising capital is as crucial as it is complex, involving a multifaceted approach beyond merely presenting financial documents. Understanding and applying various strategies for acquiring the necessary funds can set the groundwork for a thriving business, showcasing the entrepreneur's commitment to sustainability and growth. Here, we'll explore critical fundraising strategies, emphasizing the importance of a well-structured business financial plan, effective cash flow management, and using financial statements to attract potential investors.

Enhancing Your Business Financial Plan

A comprehensive business financial plan is indispensable, serving as a beacon for your journey. It should detail your business's economic situation, including anticipated expenses, operational costs, and sales forecasts. A well-articulated plan secures financing more effectively and guides sustainable business operations, highlighting the significance of a solid financial plan.

Mastering Cash Flow Management

Cash flow is the lifeblood of any business, dictating its ability to sustain operations and grow. Effective cash flow management involves meticulous planning and monitoring of cash inflow and outflow. Preparing a detailed cash flow statement and projection is crucial to anticipate future financial needs and ensure the business can meet its obligations without undue stress.

Utilizing Financial Statements

Financial statements, such as the profit and loss, balance sheet, and income statement, offer a snapshot of your business's economic health. These documents are critical for attracting potential investors and obtaining financing. They demonstrate the business's profitability, operational efficiency, and financial stability, making them essential tools in the capital-raising process.

Conducting Market Research

Market research is pivotal for understanding your industry, competition, and target market. It supports your financial planning efforts by providing data-driven insights into revenue streams and marketing strategies, enhancing your business plan's effectiveness and appeal to potential investors.

Financial Projections: Beyond the Present

Creating financial projections is more than an exercise in optimism; it demonstrates your business's potential for growth. These projections, including several financial forecasts and a break-even analysis, help investors understand the future predictions of your business, showcasing the potential return on their investment.

Exploring Various Financing Options

To mitigate risk, raising capital can be achieved through multiple channels, such as venture capital, angel investors, bank loans, and even business insurance expenses. Each option has advantages and considerations, making it essential to explore which avenue best aligns with your business's needs and goals.

Building a Strong Relationship with Investors

Finally, securing capital is not just about presenting numbers and forecasts; it's about building trust and demonstrating your value. This involves transparent communication, sharing your vision and strategy, and showing how your investment will contribute to mutual success. Remember, investors invest in people, not just businesses.

In conclusion, raising capital is a critical step in the entrepreneurial journey, necessitating a deep understanding of financial management, strategic planning, and investor relations. By crafting a robust business finance plan, managing cash flow effectively, and making informed decisions based on comprehensive market research and financial projections, entrepreneurs can confidently navigate the complexities of raising capital, setting the stage for business success and sustainability.

The Role of Strategic Financial Planning

A business finance plan is more than just numbers on a page; it reflects your vision, a detailed projection of your financial future, and a beacon that guides your decision-making process. It encompasses various elements, including cash flow forecasts, profit projections, and a comprehensive analysis of your revenue streams. This financial blueprint enables entrepreneurs to set realistic goals, manage resources efficiently, and identify potential financial pitfalls before they arise.

Navigating the Investment Landscape

Securing funding is a pivotal challenge for many aspiring business owners. A well-structured business finance plan is instrumental in navigating this landscape, offering clarity to potential investors and financial institutions about your business's viability and growth potential. Whether through venture capital, angel investors, or traditional bank loans, a compelling financial plan demonstrates your commitment to fiscal responsibility and strategic growth.

Acquiring Established Businesses: A Strategic Move

For many entrepreneurs, acquiring an established business presents a unique opportunity to bypass some of the initial hurdles of starting from scratch. A robust business finance plan also plays a crucial role in this context, providing a detailed analysis of the target company's financial health, market position, and growth prospects. This strategic move, backed by thorough financial planning, can offer a quicker path to profitability and scale.

The journey from employment to entrepreneurship is fraught with challenges and uncertainties. However, creating a sound business finance plan lays the groundwork for a successful transition. It equips aspiring business owners with the knowledge, strategies, and confidence to navigate the investment landscape, manage financial risks, and ultimately achieve their entrepreneurial goals. As we delve deeper into the intricacies of financial planning and capital raising, remember that the foundation of any successful business lies in its ability to plan and execute its financial vision strategically.

Financial Planning: The Keystone of Entrepreneurial Ventures

In entrepreneurship, the creation and execution of a financial plan stand as the cornerstone of success. This critical component outlines a business's economic trajectory and is a vital communication tool with potential investors, financial institutions, and stakeholders. The essence of a financial plan in a business plan is to forecast future economic outcomes and prepare the groundwork for sustainable growth and profitability.

The Significance of a Comprehensive Financial Plan

A well-conceived financial plan of business encapsulates various financial statements, including cash flow projections, income statements, and balance sheets. These documents collectively offer a snapshot of the business's current economic health and potential for future earnings. For entrepreneurs transitioning from employment to business ownership, understanding a financial plan for a business and integrating it into their business model is paramount. It demonstrates a commitment to fiscal responsibility and enhances the business's credibility in the eyes of finance business planning experts and investors.

Strategies for Raising Capital

Raising capital is often the most formidable challenge faced by new entrepreneurs. Here, a robust financial plan in a business plan becomes indispensable. It details the amount of capital needed, its intended use, and the projected returns on investment, thereby making a compelling case to potential financiers. Whether approaching angel investors, securing venture capital investments, or applying for small business loans, a persuasive financial plan can significantly increase the chances of securing the necessary funds.

Leveraging Established Businesses for Accelerated Growth

For those considering acquiring an existing business as a route to entrepreneurship, the financial plan in entrepreneurship plays a dual role. It assesses the economic viability of the target company and forecasts the merged entity's economic future. This strategic approach, backed by thorough financial planning for new business, can fast-track an entrepreneur's journey to profitability and success.

Navigating the intricacies of crafting a robust business financial plan is essential for transforming the abstract dream of business ownership into a tangible and successful reality. Such a plan is the linchpin in managing the complexities of business growth and investment strategies and securing the necessary funding to propel a venture forward. Understanding and incorporating essential components like the cash flow statement, profit and loss statement, and comprehensive market research into your business plan will ensure a holistic approach to financial planning.

Crafting Your Business Finance Plan: The Foundation of Entrepreneurial Success

Embarking on the entrepreneurial journey transforms the abstract dream of business ownership into a tangible reality. Developing a comprehensive business finance plan is at the core of this transformative process. This plan serves as a roadmap to navigate the complexities of business growth and investment and as a critical tool for securing the necessary funding to fuel your venture's success. The importance of a meticulously crafted business finance plan cannot be overstated, as it embodies the strategic planning, resilience, and financial acumen required to thrive in the competitive landscape of entrepreneurship.

The Role of Strategic Financial Planning

A business finance plan is more than just numbers on a page; it reflects your vision, a detailed projection of your financial future, and a beacon that guides your decision-making process. It encompasses various elements, including cash flow forecasts, profit projections, and a comprehensive analysis of your revenue streams. This financial blueprint enables entrepreneurs to set realistic goals, manage resources efficiently, and identify potential financial pitfalls before they arise.

As we conclude our exploration of the transformative journey from employment to entrepreneurship, remember that the essence of success lies in the strategic integration of a robust financial plan. This journey is replete with lessons on resilience, strategic planning, and the pivotal role of financial acumen in steering your venture toward sustainable growth and profitability. Creating a business finance plan is not just a preparatory step but the foundation upon which your entrepreneurial dreams are built and realized.

Join us on our podcast for more in-depth insights and strategies on navigating the entrepreneurial landscape, crafting your business finance plan, and achieving entrepreneurial success. Our discussions delve deeper into the nuances of financial planning, investment strategies, and the art of raising capital, equipping you with the knowledge and confidence to navigate your entrepreneurial voyage. Please tune in for a journey of learning, growth, and inspiration as we explore the pathways to entrepreneurial triumph together.

Tune In to Our Podcast:

Listen to our latest podcast episode, "Achieving Business Success: Strategies for Growth and Freedom," for actionable tips and advice on propelling your business forward. 🎧 Listen Now

Connect With Us:

Stay updated on the latest digital marketing trends, strategies, and insights by following us on social media:

📺 YouTube: Subscribe

📘 Facebook: Follow

📸 Instagram: Follow

🔗 LinkedIn: Connect

🐦 Twitter: Follow

Schedule a FREE Consultation:

Ready to take your business to the next level? Book a free consultation with us and discover personalized solutions to fuel your entrepreneurial journey! 💼 Get Started

Begin Your Transformation Today!

Request a Free Consultation to Learn How We Can Help Grow Your Business

Copyright Digital Evolution Marketing Group - All Rights Reserved

| Terms & Conditions | 1005 Terminal Way, Ste 100 | Reno, NV 89502